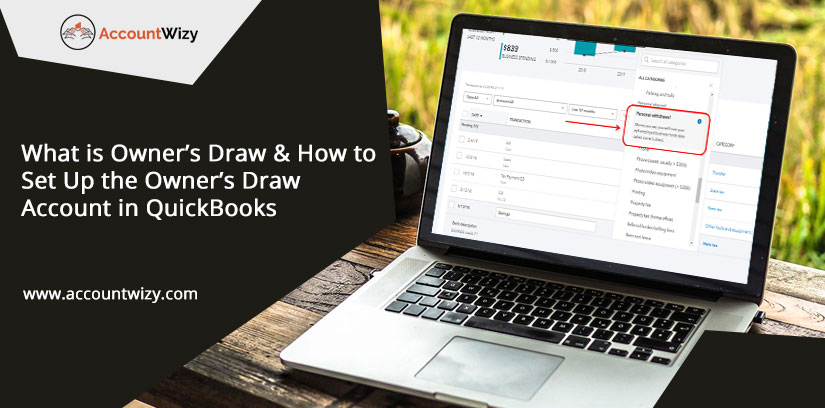

How to take an owner s draw in quickbooks

Table of Contents

Table of Contents

If you’re an entrepreneur or small business owner using QuickBooks, recording your owner’s draw is a vital step in keeping your books accurate and up-to-date. However, it can be tricky to navigate the process and ensure that you’re recording your draws correctly. In this article, we’ll cover everything you need to know about how to record owner’s draw in QuickBooks.

As a business owner, managing finances can be stressful, and keeping up with all of the different aspects of accounting can be time-consuming. One of the most significant challenges that many entrepreneurs face is accurately recording owner’s draw. Without proper accounting, it can be challenging to know where your business stands financially.

What is an Owner’s Draw in QuickBooks?

Owner’s draw is an amount that you take out of your business profits and/or equity as an owner, for personal use. When you draw the money from your business, it reduces the amount of equity in the company, which can affect the overall financial health of the business. In QuickBooks, you must record all owner’s draws correctly to ensure your books are accurate and up-to-date.

In summary, recording owner’s draw is a crucial part of accounting for business owners. It’s essential to keep accurate and up-to-date books, which requires a clear understanding of how to record owner’s draw in QuickBooks.

How to Record an Owner’s Draw in QuickBooks

Recording an owner’s draw in QuickBooks is relatively straightforward. First, you need to create an “Owner’s Equity” account if you don’t already have one set up. Once you create the account, you can then record the owner’s draw in QuickBooks using the following steps:

- Go to the “Banking” menu and select “Transfer Funds.”

- Select the account the draw is coming from and the “Owner’s Equity” account as the destination account.

- Enter the date of the draw and the amount.

- Add a memo if needed.

- Click “Save and Close.”

By following these steps, you’ll accurately record your owner’s draw in QuickBooks and keep your books up-to-date.

Additional Tips for Recording Owner’s Draw in QuickBooks

While the process of recording owner’s draw is relatively simple, there are a few additional tips to keep in mind to ensure that you’re accurately and consistently recording your draws:

- It’s crucial to separate your personal expenses from your business expenses to ensure accurate accounting.

- Record your draws at least monthly to stay on top of your books and improve your financial decision-making.

- Make sure you’re tracking all of your expenses and revenue, so you know how much you can afford to take as an owner’s draw.

Using QuickBooks for Accurate Owner’s Draw Tracking

QuickBooks is an excellent tool for recording and tracking all of your accounting needs, including owner’s draw. By keeping accurate records of your draws, you’ll be able to make more informed financial decisions and keep your business financially healthy.

FAQs: How to Record Owner’s Draw in QuickBooks

1. Can you take an owner’s draw if your business is losing money?

Yes, you can take an owner’s draw even if your business is losing money. However, it’s critical to ensure that you’re not taking more money than your business can afford. Taking money out of the business when it’s already struggling financially can be detrimental to the overall health of your company.

2. How often can you take an owner’s draw in QuickBooks?

There is no set limit on how often you can take an owner’s draw in QuickBooks. However, it’s essential to make sure you’re not taking too much too often, as this can harm the financial health of your business. As a general rule of thumb, it’s best to take a draw no more than once a month and only take what your business can afford.

3. Do you need to pay taxes on an owner’s draw?

As an owner’s draw is not considered part of your salary or wages, you do not need to pay employment taxes on it. However, the money you take out of the business as an owner’s draw is subject to income taxes, so it’s important to keep accurate records of all draws to ensure that you’re paying the correct amount of taxes at the end of the year.

4. Can you reverse an owner’s draw in QuickBooks?

Yes, you can reverse an owner’s draw in QuickBooks if you need to make an adjustment to your books. To do so, go to your “Bank Feeds Center,” select the transaction you want to reverse, then select “Undo.”

Conclusion of how to Record Owner’s Draw in QuickBooks

Recording owner’s draw in QuickBooks is an essential task for any entrepreneur or small business owner. By accurately recording your draws, you can keep your books up-to-date and make more informed financial decisions. Remember to record your draws regularly, keep accurate records, and use QuickBooks to manage all of your accounting needs.

Gallery

Direct Deposit Owner’s Draw Quickbooks - Do Your Best Webcast Pictures

Photo Credit by: bing.com /

Owner’s Draw In QuickBooks (Members Draw QuickBooks)

Photo Credit by: bing.com / quickbooks

How To Take An Owner’s Draw In Quickbooks - Masako Arndt

Photo Credit by: bing.com /

How To Record An Owner’s Draw - The YarnyBookkeeper

Photo Credit by: bing.com /

How To Record An Owner’s Draw - The YarnyBookkeeper

Photo Credit by: bing.com /